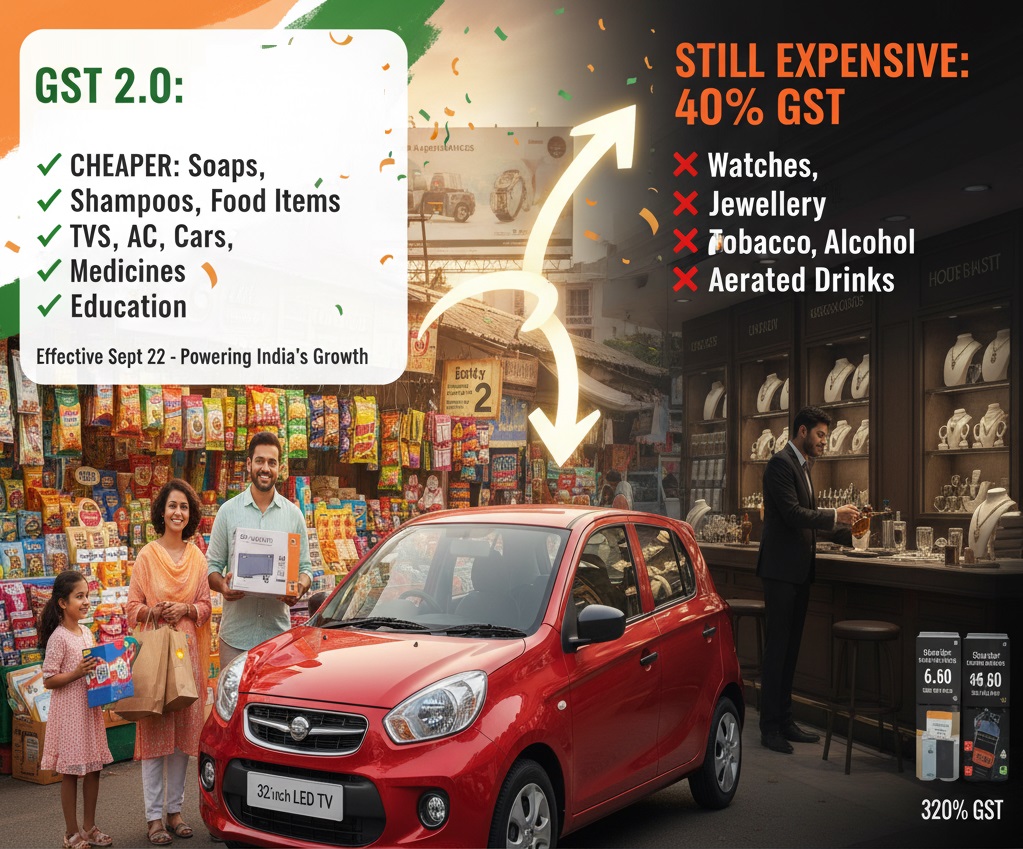

The Goods and Services Tax (GST) Council has introduced a significant rationalisation of GST rates, effective from Monday, September 22. The reform, popularly being called GST 2.0, is expected to bring relief to lower and middle-income groups, simplify the tax structure, and make a wide range of everyday goods and services more affordable across India.

Simplified GST Structure

The new GST framework has streamlined multiple slabs into three main categories:

- 5% GST for essential items

- 18% GST for most goods and services

- 40% GST for luxury and “sin” goods, including tobacco, alcohol, and online betting

Finance Minister Nirmala Sitharaman said the rationalisation aims to benefit consumers while supporting businesses and stimulating economic growth. Prime Minister Narendra Modi described the reform as a “double bonanza” for the poor and middle class, boosting demand and lowering prices

Everyday Items That Are Cheaper

The biggest relief comes in the form of reduced tax on daily essentials:

- Personal Care Products: Soaps, shampoos, toothpaste, hair oils – now taxed at 5%, down from 18%

- Food Items: Dry fruits, biscuits, cereals, fruit juices, and Indori namkeen have become more affordable

- Beverages: Fruit juices and coffee blends see price drops; bottled water is slightly cheaper, though aerated drinks remain expensive

Home Appliances and Electronics

Household gadgets and electronics have also benefited from GST rationalisation:

- Air Conditioners: Now under 18% GST, down from 28%

- Televisions: TVs above 32 inches see price cuts of up to ₹85,000

- Dishwashers and Computer Monitors: Taxed at 18%, leading to lower retail prices

Automobiles

The automotive sector enjoys major tax relief:

- Small Cars and Two-Wheelers: GST reduced from 28% to 18%, making them more accessible to the middle class

Healthcare, Insurance, and Education

- Medicines: 33 life-saving drugs are tax-free, while others have dropped from 12% to 5%

- Medical Devices: Spectacles, diagnostic kits, and other devices see reduced taxes

- Insurance: Life and health insurance premiums are exempt from GST

- Education: Notebooks, pencils, and other learning materials are now tax-free

Construction and Agriculture

- Cement: GST reduced to 18%, lowering construction costs

- Renovation Materials: Marble, granite, and sand-lime bricks now taxed at 5%

- Agricultural Equipment: Tractors, drip irrigation systems, and tractor parts attract 5% GST

Items That Remain Costly

Despite the reforms, some goods remain in higher tax brackets:

- Luxury items like watches, jewellery, and premium handbags

- Tobacco and alcohol products

- Aerated beverages

The GST rationalisation is expected to increase consumer purchasing power, simplify compliance for businesses, and support India’s economic growth. With the festive season approaching, households across the country are likely to benefit from lower prices on essential items, electronics, automobiles, healthcare, and educational supplies.