Are you one of the millions of Indians who avoid checking your CIBIL score, fearing it will harm your creditworthiness? You’re not alone. This is one of the biggest financial myths in the country. But with the Reserve Bank of India (RBI) rolling out new credit reporting rules in 2025, it’s more important than ever to separate fact from fiction.

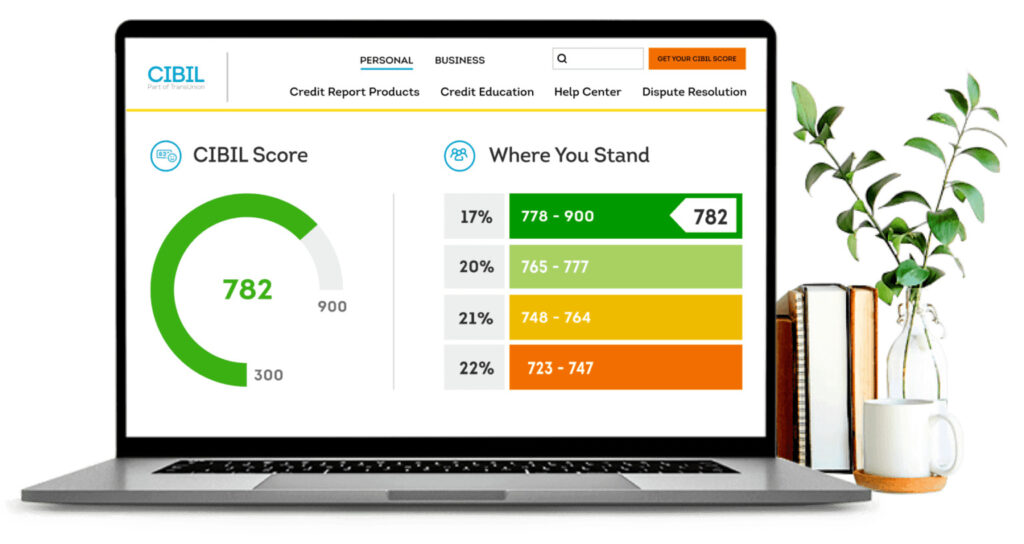

A healthy credit score, ideally 750 or higher, is your key to getting approvals for loans and credit cards at the best interest rates. This guide will bust the most common CIBIL score myths, explain the impact of the new RBI rules on credit scores, and give you practical steps to build a strong financial future.

The Big Myth: Does Checking Your CIBIL Score Really Hurt It?

Let’s clear this up immediately: Checking your own CIBIL score does NOT lower it.

When you check your own score on the CIBIL website, a banking app, or any other platform, it is classified as a “soft inquiry.”

- Soft Inquiry (The Safe Check): This is a personal review of your credit report. Think of it as looking at your financial report card. It is only visible to you and has zero impact on your score. You can and should check your score regularly without any fear.

- Hard Inquiry (The Real Impact): This happens when you formally apply for credit, like a personal loan, home loan, or a new credit card. The lender pulls your report to assess risk. Multiple hard inquiries in a short span can signal to lenders that you are “credit hungry,” which may slightly lower your score, typically by a few points. These inquiries stay on your report for two years.

Pro Tip: Plan your credit applications. Avoid applying for multiple loans or cards all at once to minimise the impact of hard inquiries.

RBI’s 2025 Rules: A New Era for Your Credit Score

The RBI’s new credit reporting framework, fully effective in 2025, is set to make the system more transparent and responsive for you, the borrower.

- Faster Updates Mean a More Accurate Score: Until now, lenders reported your payment data to CIBIL and other bureaus monthly. Under the new rules, they must report every 15 days. This means your good financial habits, like paying an EMI on time, will reflect and potentially improve your CIBIL score much faster.

- More Power to You: Enhanced Consumer Protection: If a loan application is rejected due to a low credit score, lenders are now required to:

- Clearly explain the reasons for the rejection in writing.

- Give you a 30-day window to correct any errors on your credit report.

- Resolve any credit report complaints within 30 days, with potential compensation for delays.

Busting Common CIBIL Score Myths in India

Beyond the main myth, several other misconceptions can lead to poor financial decisions.

- Myth: “My monthly income is a major factor in my CIBIL score.”

- Reality: Wrong. Your income is not part of the CIBIL score calculation. Lenders consider your income separately, but the score itself is based on your repayment history and credit management.

- Myth: “Closing my old credit card will boost my score.”

- Reality: This can actually hurt your score. A long credit history is a positive factor. Closing an old account shortens this history and reduces your total available credit limit.

- Myth: “CIBIL score is the only credit score in India.”

- Reality: While TransUnion CIBIL is the most popular, India has three other RBI-authorised credit bureaus: Experian, Equifax, and CRIF Highmark. It’s wise to check your report with each one annually.

Actionable Tips to Build and Maintain a High CIBIL Score

Maintaining a score above 750 is achievable with disciplined habits.

- Never Miss a Payment: Your payment history is the single most important factor. Set up auto-debit for all your EMIs and credit card bills.

- Keep Credit Utilisation Low: Use less than 30-40% of your total credit card limit. High utilisation is a red flag for lenders.

- Maintain a Healthy Credit Mix: A combination of secured loans (like a home or car loan) and unsecured loans (like credit cards or personal loans) is viewed favourably.

- Monitor Your Score Regularly: As we’ve established, checking your score is safe. Use the RBI mandate to get one free CIBIL score check from each of the four bureaus every year.

Conclusion: Take Control of Your Financial Health

The fear that checking your CIBIL score will lower it is officially busted. Regular monitoring is not just safe; it’s one of the smartest financial habits you can adopt. With the new 2025 RBI rules bringing more transparency and accuracy, there has never been a better time to proactively manage your credit health.

Stay informed, check your score regularly, and use that knowledge to build a credit profile that opens doors to your financial goals.